Despite its massive potential, corporate Asia still lags behind its counterparts in the world. Why?

Asia has seen rapid growth and rise to prominence in the past decade. It is filled with market opportunities and has proven itself resilient in times of crisis. However, it remains behind other global economies in terms of economic profit.

In the discussion paper, The future of Asia: Decoding the value and performance of corporate Asia, the McKinsey Global Institute (MGI) examines the reasons why this is the case.

Understanding Asia’s corporate performance

Today, 43 percent of the world’s largest firms can be found in Asia — the highest share across all major economies. Over the past decade, however, Asia accounts for half (47%) of the decline in economic profitability in the world.

Comparing the 2005-2007 profits to that of 2015-2017, this translates to a staggering decline of USD 358 billion in economic profit.

McKinsey identified three factors which contribute to the underperformance of Asian companies:

01. The cyclicality of returns in the energy and materials sector.

Energy and materials were major sources of profit in the preceding decade. However, the recent decline in oil and commodity prices resulted in enormous damages.

02. Allocation of capital to value-destroying sectors.

Sectors, where the Return on Invested Capital (ROIC) is less than a firm’s weighted average cost of capital (WACC), is classified as value-destroying. About 75% of the capital invested by Asia in the past ten years was invested in these sectors, more than any region in the world.

03. Corporate underperformance.

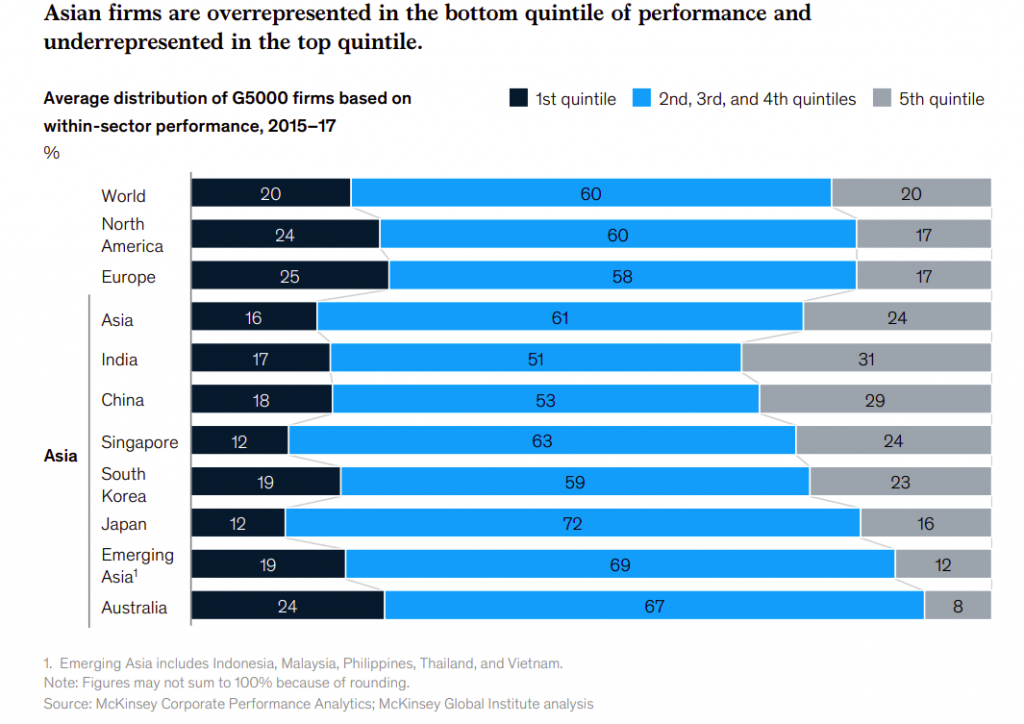

A high concentration of Asian firms is located in the bottom quintile of economic performance where value tends to be destroyed.

Corporate Asia tends to underperform in high-value sectors like information technology, pharmaceuticals, and consumer goods and services.

Positioning for the post-pandemic world

By improving the performance of individual firms and investing in value-creating sectors, MGI estimates that Asia could unlock between USD 440 billion to USD 620 billion in economic profit.

MGI identified five sectors where addressing performance gaps can help boost profitability:

- Pharmaceuticals

- Consumer goods

- Energy and materials

- Real Estate

- Banks

Against the backdrop of a global pandemic, corporate Asia needs to maintain its resilience and also build capabilities for long-term growth. Three priorities are pinpointed by MGI:

- The acceleration of digital adoption and using digital technology to heighten productivity. Especially in the context of the COVID-19 pandemic, these capabilities are proven to be critical.

- Scaling up through the exploration of opportunities for mergers and acquisitions (M&A).

- Portfolio management, including diversification, scaling, and dynamic allocation of resources.

While the post-pandemic world will entail a huge amount of time dedicated for crisis management and recovery, MGI recommends that companies also launch a plan-ahead team which apart from looking at the day-to-day crisis will also explore strategies on how long-term opportunities can be successfully tapped into.

Because of how colossal it is, corporate Asia may be playing a huge role in forging the path to the next normal. The world after the pandemic will be a test of resilience, agility, and adaptability. As it has proven in the previous crisis events in the world, it has the capacity to bounce back.