We would like to thank our generous sponsors for making this article possible.

Despite efforts to advance gender equity, women still lag behind men in home ownership, labor force participation, board representation and many more areas. Here’s why.

- While the percentage of women re-entering the workforce has increased post-pandemic, the overall labor force participation rate (LFPR) for women remains low at just under 47%, compared with 72% for men.

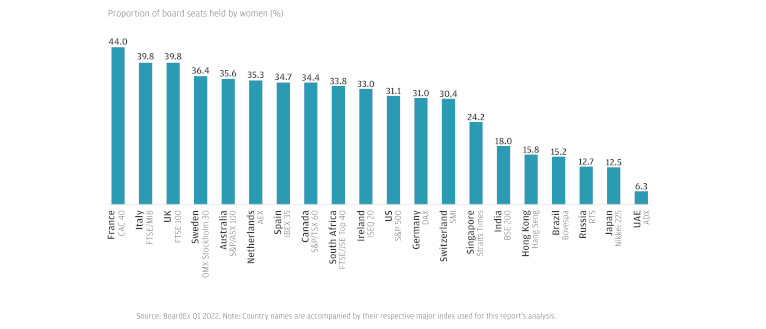

- Female representation on corporate boards varies greatly across the globe. France has the highest share of female board members at 44%, compared with just 6.3% in the UAE.

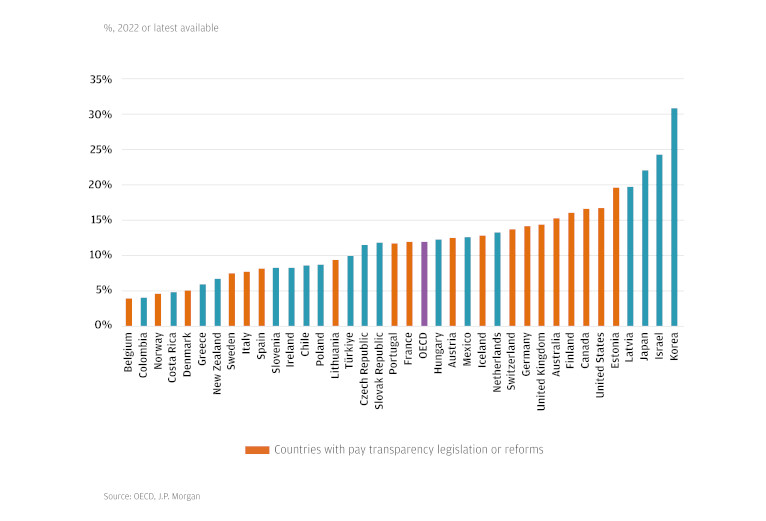

- The gender pay gap is declining across most regions, but it remains high in countries such as South Korea (31.5%) and Israel (24.3%).

Despite efforts to advance gender parity, women still lag behind men in many areas — from home ownership to labor force participation and board representation. “While the COVID-19 pandemic brought about unprecedented gender-responsive policies, it did little to effect structural change,” said Amy Ho, who covers Strategic Research at J.P. Morgan. In fact, the World Economic Forum estimates it will take another 132 years to close the global gender gap — a generation longer than the 100-year estimate prior to the pandemic.

Below, J.P. Morgan Research examines the current state of global gender equity — the progress that has been made, and the progress there is still to achieve.

Labor force participation

Labor force participation has now largely normalized to pre-pandemic levels, after millions of working mothers left their jobs to care for their children during the COVID-19 lockdowns. “2022 was noteworthy for women’s re-entry into the labor market, reversing the historic setbacks of 2020 and 2021,” said Joyce Chang, Chair of Global Research at J.P. Morgan. According to the International Labor Organization (ILO), the labor force participation rate (LFPR) in the U.S. for women aged 25 to 54 reached 77% in January 2023, exceeding the level in 2019 (76%).

On a global scale however, the overall LFPR for women remains low at just under 47%, compared with 72% for men. “Caregiving responsibilities remain a key barrier holding women back from obtaining employment,” noted Chang. Yet, the value of unpaid care and domestic work — estimated to be between 10% and 39% of a country’s GDP, according to the United Nations (UN) — has the potential to contribute more to the economy than the manufacturing, commerce or transportation sectors.

Female employment rates and labor force participation rates are historically lower in emerging markets (EMs), but women here have mostly caught up to their counterparts in developed markets (DMs) in terms of returning to the workforce. “However, there were wide regional variations during and after the pandemic. Employment rates in EMs across Asia and EMEA were surprisingly stable while in Latin America, labor markets were by far the worst affected,” said Katherine Marney, who covers EM Economics and Policy Research at J.P. Morgan.

2022 was noteworthy for women’s re-entry into the labor market, reversing the historic setbacks of 2020 and 2021. However, caregiving responsibilities remain a key barrier holding women back from obtaining employment.

Joyce Chang

Chair of Global Research, J.P. Morgan

Board and c-suite representation

Globally, female representation on leading corporate boards is greater than it was a decade ago. However, progress varies significantly across regions and countries. France has the highest share of female board members at 44% but the figure stands at just 12.5% in Japan and 6.3% in the UAE, according to Rie Nishihara, Japan Chief Equity Strategist at J.P. Morgan.

Women on boards

Mandatory quotas are helping to drive progress. In the EU, for example, companies must ensure that women have at least 40% of board seats by 2026. “Almost all countries have progressed on board gender diversity metrics, but in order to reach gender parity by 2030, the percentage of women joining boards on an annual basis needs to surpass 50%,” said Stella Xu, who covers Strategic Research at J.P. Morgan.

At the C-suite level, female CEOs of Fortune 500 companies finally reached the 10% threshold in early 2023 for the first time in history. “However, women of color are still dramatically underrepresented, and women account for only 5% of CEOs across emerging markets,” noted Xu. In addition, attrition is high. Research by LeanIn and McKinsey shows that for every woman director who is promoted, two other women directors are choosing to leave their company, with many downshifting for better work-life balance.

The Gender Pay Gap

The wage gap — or the relative difference between average or median hourly earnings for female and male employees as a fraction of male earnings — is a key indicator for monitoring progress toward gender pay equity. It continues to decline across most regions: For instance, in the EU, it decreased from 16.4% to 13% between 2012 and 2020. On the contrary, it remains high in countries such as South Korea, where women make less than 69% of what men earn.

“However, a portion of the overall pay gap likely reflects an underrepresentation of women in the highest paying fields, especially as women have historically made up the majority of workers in many service industries,” said Phoebe White, who covers U.S. Rates Research at J.P. Morgan. For example, in frontline operational roles, the overall gender pay gap stands at 11%, whereas it increases to 38% for senior and leadership roles. Even when controlling for job characteristics, women at the executive level still earn only 95 cents for every dollar earned by men.

“Pay transparency legislation is key to closing the gender pay gap, as it provides workers with the means to negotiate salaries and challenge potential pay discrimination,” noted Emily Macpherson, who covers Australia ESG Research at J.P. Morgan. Such legislation is becoming more widespread in the U.S., where certain states require employers to publish a pay scale in job listings; Japan and Australia are expected to pass similar laws. In the U.K., organizations with at least 250 employees have to disclose pay gap data annually.

Gender pay gap across countries

Home ownership

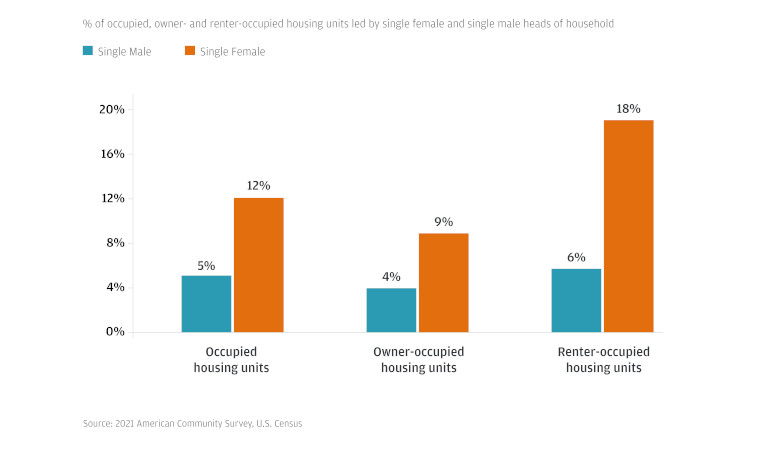

In the U.S., the homeownership rate for single women has increased over the past few decades. According to the American Community Survey, roughly 9% of occupied units today are owned by single female heads of household, while only 4% are owned by their male counterparts. “The improvement in the homeownership rate can largely be attributed to more women having access to higher education and income levels,” said Ani Gelashvili, who works in Securitized Products Research at J.P. Morgan.

However, challenges remain. Although women now account for a higher share of homeowners, there are still more female renters than men. In a consumer research survey conducted by Freddie Mac, 60% of single female households feel that homeownership is indefinitely out of reach for them. This may be because single women make less money than single men; in order to afford a median-priced house today, a typical household needs to earn more than $70K a year, which is significantly higher than the median annual income for single female heads of household ($51K).

Single female renters outnumber single male renters

Public leadership

“By a number of metrics, women have achieved their highest representation in public leadership roles,” said Chang. In the U.S., for example, women now make up 28% of all members of the 118th Congress — the highest percentage in history, although it remains far below women’s share of the overall U.S. population (58.7%).

Despite this, there is still a lot more progress to be made. At the global level, the UN reports that as of January 2023, there are 31 countries where 34 women serve as Heads of State and/or Government. Only 26.5% of government ministers are women, with just six countries (including Rwanda, Mexico and New Zealand) having 50% or more women in cabinets.

Again, legislation is critical to increasing women’s political participation in national parliaments. More than two-thirds of the countries that surpass the 40% threshold for women in ministerial positions have applied gender quotas — either legislative candidate quotas or reserved seats. Based on the current rate of progress, however, UN Women estimates that gender parity in national legislative bodies will not be achieved before 2063.

Gender equity at JPMorgan Chase

As of the fourth quarter of 2022, women represent 49% of our global workforce, 40% of our EMEA workforce and 39% of our Operating Committee. In the U.K., our mean hourly pay gap has narrowed by -3.2% year-over-year (from 30.9% to 27.6%), and our median hourly pay gap has decreased by -4.1% (from 23.9% to 19.8%).

We are committed to further advancing gender equity and inclusion across the firm. These are some of the key initiatives in place to support women at JPMorgan Chase:

- Winning Women. Aimed at undergraduate women, the program provides an entry point into financial services and a meaningful overview of the many opportunities for leadership at the firm.

- ReEntry Program. The program offers support and resources to experienced professionals who have taken an extended career break, helping them re-enter the workplace. In 2022 alone, more than 130 professionals returned to work via ReEntry.

- Women on the Move. This initiative provides multiple programs and resources to expand women-run businesses, as well as improve financial health and advance career growth for women.

- Parents@JPMC. Parents at JPMorgan Chase can access practical support and tools as well as have the chance to meet and learn from others. The firm has also recently enhanced its parental leave policies globally.

This communication is provided for information purposes only. Please read J.P. Morgan research reports related to its contents for more information, including important disclosures. JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively, J.P. Morgan) normally make a market and trade as principal in securities, other financial products and other asset classes that may be discussed in this communication.

This communication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy except with respect to any disclosures relative to J.P. Morgan and/or its affiliates and an analyst’s involvement with any company (or security, other financial product or other asset class) that may be the subject of this communication. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. J.P. Morgan Research does not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein. Periodic updates may be provided on companies, issuers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, J.P. Morgan may be restricted from updating information contained in this communication for regulatory or other reasons. Clients should contact analysts and execute transactions through a J.P. Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of J.P. Morgan. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitutes your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of J.P. Morgan.

Originally published at: J.P. Morgan