We would like to thank our generous sponsors for making this article possible.

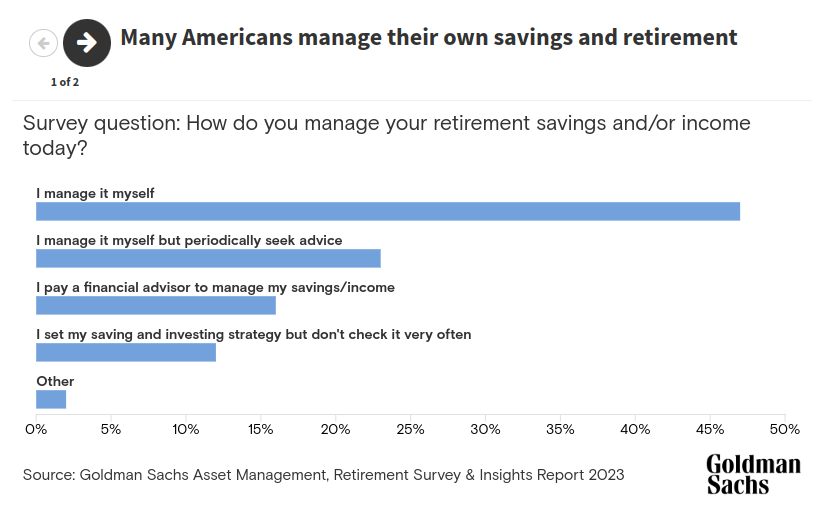

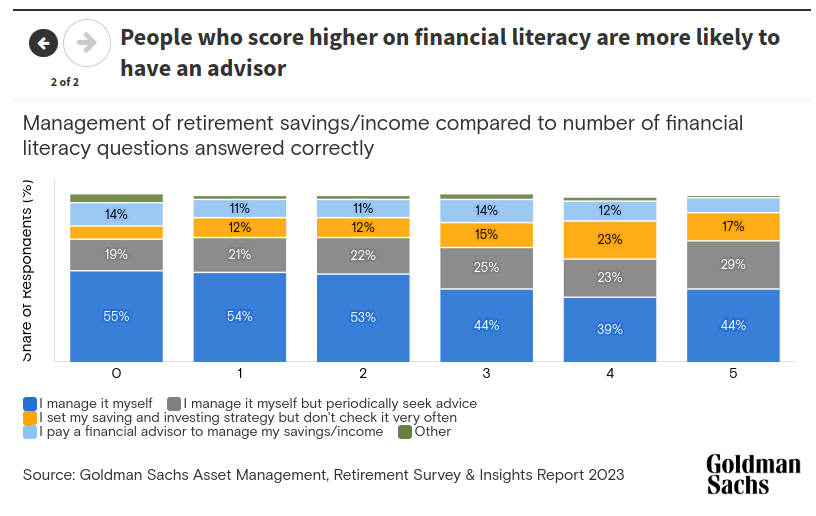

Americans who are less familiar with basic financial concepts may, counterintuitively, be more likely to manage their own retirement savings. Our survey also found that savers who are more financially literate tend to have less stress when it comes to managing money and the financial priorities that come with retirement.

Those are among the findings in the Goldman Sachs Asset Management Retirement Survey & Insight Report, which suggest hard-to-predict financial challenges have become more frequent. It also underscored a link between financial acumen and confidence in navigating competing priorities.

Almost half of the respondents to the survey manage their own retirement savings, yet only 13% correctly answered all five of the survey’s financial literacy questions. The survey shows that the fewer questions respondents answered correctly, the more likely they were to manage their own savings. Conversely, those who answered correctly were more likely to seek professional advice. Of those surveyed, 47% said they self-manage their retirement savings, while 23% seek retirement advice, and 16% use a financial adviser.

“Despite the fact that financial literacy is low, many individuals continue to manage their retirement assets by themselves,” Mike Moran, a pension strategist for Goldman Sachs’ Asset & Wealth Management, says in an episode of the Goldman Sachs Exchanges podcast. “They don’t seek professional advice. And given low financial literacy, that feels like that’s something that needs to change.”

Investors who understand key financial concepts were less likely to report a high impact from other financial obligations on their retirement savings, suggesting people with basic financial knowledge may be better equipped to navigate what Goldman Sachs Asset Management calls the “financial vortex” of competing financial priorities that can crowd out retirement savings. Moran points out that high schools and colleges haven’t usually had financial literacy as part of the curriculum. “We’re starting to see that change,” says Moran, who teaches an evening class on personal financial planning at a local university.

That said, the survey suggests retirement planning, while important, doesn’t always make stress evaporate. Moran notes that those who had a plan were more likely to say they were impacted by financial-vortex attributes than those who didn’t have a plan, and they remained concerned about the impact of competing financial priorities.

Planning “can also heighten savers’ awareness of the financial vortex,” according to the report. “Those without a plan report feeling less impacted by competing financial priorities than those with a plan. This paradox highlights the need for personalized support that goes beyond planning.”

How much should I have saved by retirement age?

As Americans have transitioned to a defined contribution system like the 401(k) as the primary retirement vehicle, the onus is generally on the individual to invest their money for retirement and ensure they don’t outlive their assets in retirement.

Generation X will be the first to rely primarily on 401(k) plans to fund their retirement, and they face a narrowing window for closing any savings gaps. Millennials and Generation Z report the highest impact of competing priorities, and they may require a more personalized level of support to navigate these challenges, according to the report.

“Many older generations were covered in private employment by a defined benefit pension plan,” Moran says. “So they were getting a monthly check in retirement from their former employer. They were covered by Social Security. And then they had private savings. So this is a significant moment in time where we’re starting to see more and more individuals retire that are solely covered by a defined contribution plan.”

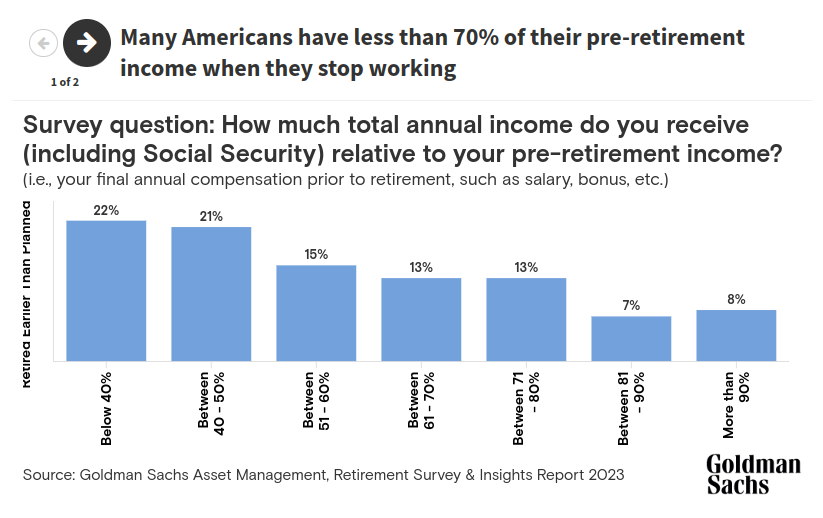

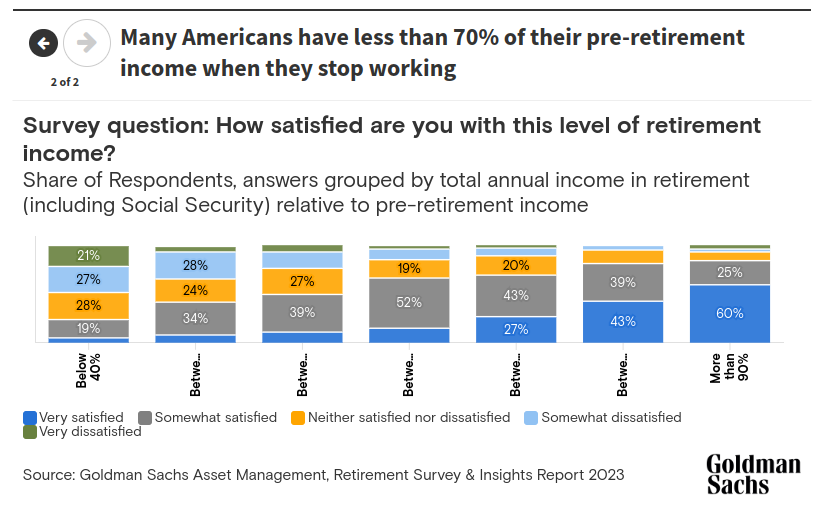

While a rough industry benchmark is that a retirement strategy should cover 70% of a retiree’s pre-retirement income, many have less than 50%, Moran says. The biggest reason is competing financial priorities, which can have a significant impact on retirement savings.

“A lot of that comes back to what we call the financial vortex,” Moran says. “If you think about having credit card debt, if you think about having some sort of emergency expense — your car breaks down, you have a home repair that you didn’t anticipate, or maybe you have to take time out of the workforce to care for a young child or maybe even an elderly family member. Those can all constrain the amount you’re saving for retirement, and therefore people are sometimes getting to retirement without enough assets.”

Without the appropriate interventions, common life events and unanticipated financial demands can swamp retirement savings efforts. In Goldman Sachs Asset Management’s analysis, someone who had to stop saving due to multiple life events would have about 40% less total savings than a person able to save consistently from age 25 to 65. This shows that consistent saving is critical for a retirement strategy, but in an employer-based retirement system, job changes, caregiving, financial hardships, or early retirement all can derail this strategy. And for savers who are still working, higher borrowing costs — on mortgages, cars, and other big-ticket items — can crimp budgets and make it more difficult to save for retirement.

How to keep retirement on track

Another concern is higher inflation, which raises the short-term costs of household goods, food, gas, and other essentials while also decreasing the purchasing power of assets in retirement. Credit card debt can reduce the ability to save for retirement as well.

And while many investors assume they can put off retirement if they must, far fewer are prepared to be forced into retirement early. About two-thirds of survey respondents who were still working said they expect competing priorities to delay their retirement, and around half said they expect the delay to last for a year or more.

But people actually in retirement often discover that their working years end earlier than expected — not later. Half of the of the retirees surveyed said they retired before they expected, and about 47% of them retired for reasons outside of their control. What’s more, more than half of those who were forced to retire early said it happened more than four years sooner than they had planned.

These unexpected challenges underscore the need for retirement planning. “There are a lot of benefits to having a plan,” Moran says. It can “make people feel like they’re more in control. As we all know, when we feel like we’re in control, we feel better about things. If I’m out of control, every time my car has a flat tire or something broke in my house, I’m scrambling for money, I don’t have control and my stress levels go higher.”

Defined contribution plans like 401(k)s and IRAs now have more options for investors, such as target-date funds that can be tailored to an anticipated retirement date. Target-date funds are designed such that, as savers get closer to retirement, a professional manager rebalances and restructures the portfolio to reduce equity exposure and increase fixed-income holdings to reduce volatility. Moran says he expects the retirement market to become more personalized and tailored as it evolves. He also points out that Secure 2.0 Act allows plan sponsors to embed an emergency savings program in their 401(k) plan. That way employees are able to build an emergency savings account to pay for unexpected financial obligations without having to stop saving for retirement.

“Our survey says more people are increasing their savings for retirement,” Moran says. “The question for a lot of them going forward is: How do we maintain that savings?”

Professional advice can help with decumulation

Younger generations retiring on a defined contribution program must also consider the decumulation phase — when it’s time to use the savings built up during the retirees’ working years, hopefully without outliving those assets. Goldman Sachs Asset Management’s survey indicates many investors aren’t working with financial advisers in making these plans.

And as shown previously, we believe people who scored higher on financial literacy questions are more likely to use a financial advisor than those with lower scores.

“People who need the most help are not the ones who are seeking out that through professionally managed advice,” Moran says. “You have to think about not just the cost but also what’s the cost of not doing it correctly.”

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Originally published at: Goldman Sachs