We would like to thank our generous sponsors for making this article possible.

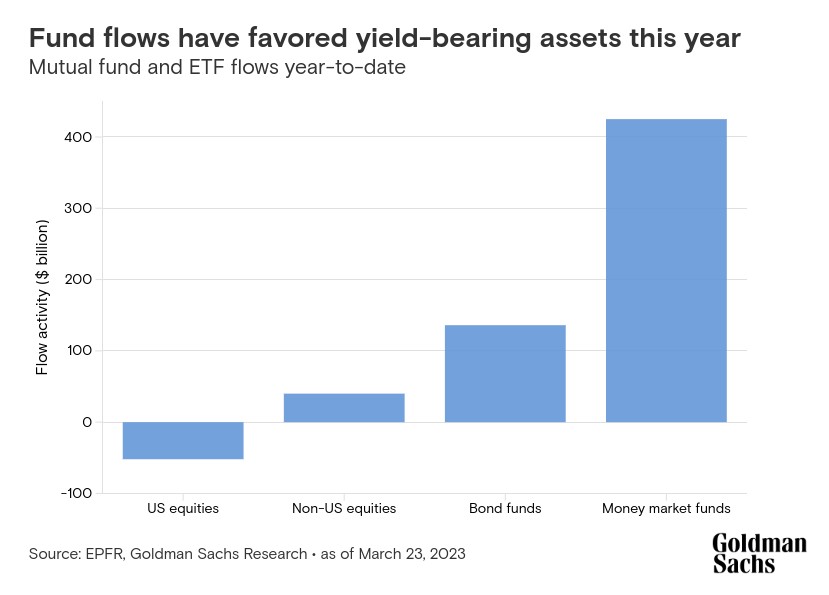

The flow of money in the U.S. into bond and money-market funds accelerated over the last two weeks amid jitters about the banking sector. The surge added to the shift in flows this year from stocks to lower-risk assets that offer more yield, according to Goldman Sachs Research.

The rise in yields shows that the era of “there is no alternative” (TINA) to stocks is over, as now “there are reasonable alternatives” (TARA), Goldman Sachs strategists Cormac Conners and David Kostin write in the team’s report. U.S. Treasuries that mature in two years yield about 4%, up from around 2.4% a year ago. “The year-to-date flows into money market and bond funds signal an escalating household shift away from equities and toward the alternatives,” Conners and Kostin write.

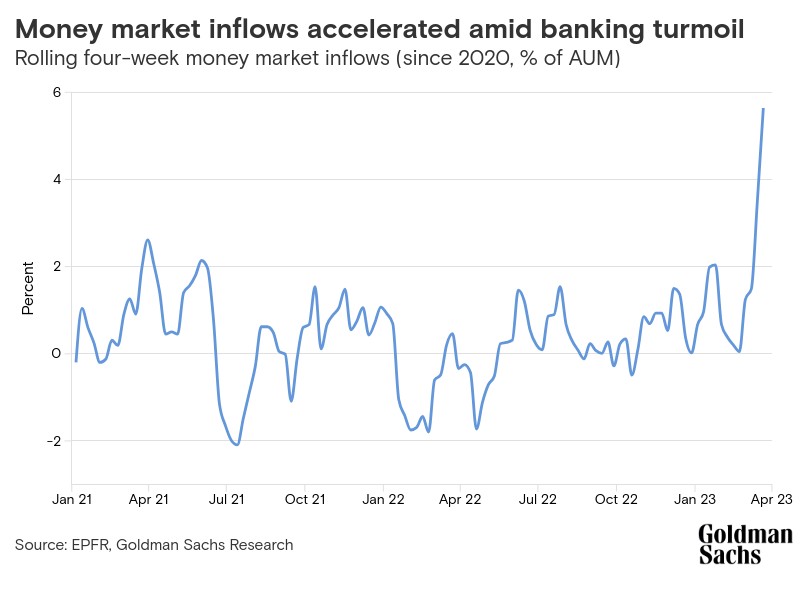

Some $136 billion poured into U.S. money market funds last week — the fourth-largest weekly inflow since 2007, Goldman Sachs Research strategists write. That follows $116 billion of flows the previous week.

But even before the recent stress in the banking sector, flows data showed a growing preference among households for lower-risk, yield-bearing assets. Households have been net sellers of U.S. stocks this year: $52 billion has flowed out of U.S. equity ETFs and mutual funds. Investors have bought money market (+$425 billion), bond (+$136 billion) and foreign equity funds (+$40 billion) during that span.

In some respects, the past decade or so has been exceptional, but that’s coming to an end. The rock bottom interest rates that followed the financial crisis drove many investors, including individuals, to buy more high-risk assets like stocks. In the average year from 2010-2021, households were net buyers of equities worth 0.2% of their financial assets. In contrast, in the average year since 1980 households sold equities worth 0.4% of their financial assets. Over the long run, household net equity demand has been negative, as equities tend to appreciate and households withdraw more capital than they invest.

Retail investors are expected to rotate hundreds of billions from stock funds to bond funds this year. Our strategists find that higher 10-year Treasury yields and lower savings rates tend to be associated with reduced net demand for stocks from households.

After plugging in Goldman Sachs economists’ forecasts, our strategists expect (in their base case) households to sell $750 billion of stocks this year as they rotate into bond and money market funds. Those outflows are expected to be offset by more than $1 trillion flowing into equity funds from foreign investors, companies and pension funds.

As households shift out of stocks, Goldman Sachs Research expects them to move their money into credit and money market assets (which is what has tended to happen in the past). Some $87 billion has flowed of out U.S. equity mutual funds and ETFs since mid-year 2022, according to EPFR data. Meanwhile, the significant recent inflows to bond and money market funds suggest the household rotation away from equities and toward alternatives is well underway.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Originally published at: Goldman Sachs