With more Singaporeans investing now despite the uncertainty and volatility in the market, the need for investors to invest in safe-haven assets such as gold and silver to balance their portfolios is greater than ever.

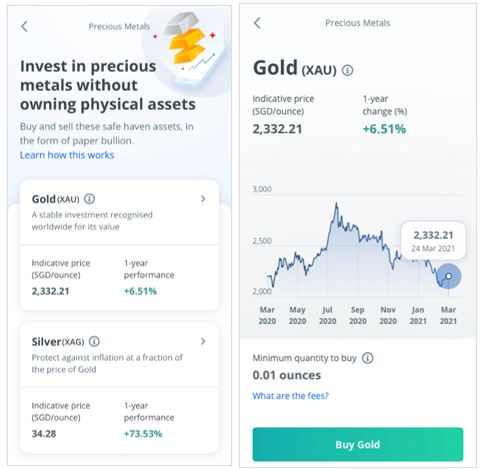

OCBC Bank is enabling investors to buy precious metals such as gold and silver quickly and easily. Since 25 October 2021, investors have been able to instantly set up an account to buy or sell gold and silver paper bullion on the OCBC Digital mobile banking app – the only financial institution in Southeast Asia to enable this. Investors can purchase these metals in real-time, starting from quantities as low as 0.01 oz.

In the past, Singaporeans interested in buying these precious metals would have to wait for several days before their account to invest in precious metals is approved, or they had to walk into a bank branch or retailer to buy physical gold bars and worry about where to store them securely.

Within the first week of the introduction of this new feature, more than S$1 million and 3,698 oz. worth of the precious metals have been purchased on the app, with a clear preference for gold.

This market-leading digital service lets customers invest in gold and silver at prices based on live market data, and in accessible and affordable quantities. With as little as S$25 for gold and 35 cents for silver, customers can pay for their precious metals directly from their OCBC Bank accounts, including OCBC foreign currency accounts. By owning gold and silver digitally, customers avoid the costs and hassle typically associated with the logistics, storage and security of owning the physical assets.

This feature extends OCBC Bank’s drive to bring immediacy, accessibility and simplicity to digital wealth management on the OCBC Digital banking app. Following the recent roll out of its foreign exchange trading and equities trading services on the app, OCBC Digital now houses one of the most comprehensive shelves of digital wealth investment products available to any customer in Singapore.

Mr Aditya Gupta, OCBC Bank’s Head of Digital Business and Transformation, said: “Inclusive. Intuitive. Immediate. This has been our north star as we add the precious metals trading service to our extensive suite of digital wealth management products and services. In this new normal of market volatility, gold and silver have seen an increased interest among investors, and we are plugging this surge in demand by democratising its access to a wider set of customers. This is our latest step in opening up new investment avenues for our customers and empowering them to further diversify their portfolios digitally.”

Why gold and silver help protect your investments

More Singaporeans are now taking an interest in investments. The recent OCBC Financial Wellness Index 2021 found that 82 per cent of Singaporeans have investments, up from 69 per cent last year.

As the world went into a state of shock in 2020 due to the Covid-19 pandemic, the demand for precious metals has climbed, and it is not just savvy investors who are looking to diversify their portfolios with safe-haven assets known to retain their values even in uncertain times. This is reflected in the exponential appreciation in their values – gold is up 45 per cent and silver is up 60 per cent from March 2020 – when the Covid-19 pandemic hit markets hard. Based on data from the World Gold Council, gold demand in Singapore hovered at 2.7 tonnes in the second quarter of 2021, up 125 per cent year-on-year.

Off the back of volatile markets, even younger investors are gravitating to these safe-haven assets. More than 7 in 10 investors in the Precious Metals portfolio on OCBC RoboInvest – the robo-investment service available on the OCBC Digital app – are under 40 years old. Investments into the portfolio have been climbing steadily at about 5 per cent month-on-month this year and continue to make up 5 per cent of overall monthly investments on the platform. Year-on-year, investments into precious metals on OCBC RoboInvest have grown 30 per cent.

Vasu Menon, OCBC Bank’s Executive Director of Investment Strategy, said: “We are living in unprecedented times as the world gradually emerges from a crisis unlike anything it has seen for nearly a century. Investment markets continue to face several challenges and uncertainties in the coming years, and it is unlikely that we will see clear blue skies anytime soon. Investors must live with this new normal for many more years, and one way to protect investment portfolios is to buy gold, which is a good portfolio diversifier and a hedge against uncertainties and risks.

“Gold lacks credit or default risks and it is not linked to corporate fundamentals which may deteriorate when uncertainties cause economic fundamentals to deteriorate. Gold prices tends to go up when interest rates go down along with a weak economy. In this sense, gold can serve as a hedge against economic uncertainties or even a potential recession. This is not to suggest that we see a recession or a sharp slowdown anytime soon. Nevertheless, it may still make sense to take a small position in gold as an insurance against unexpected events which could hurt economic fundamentals.”

Buying gold and silver digitally with ease

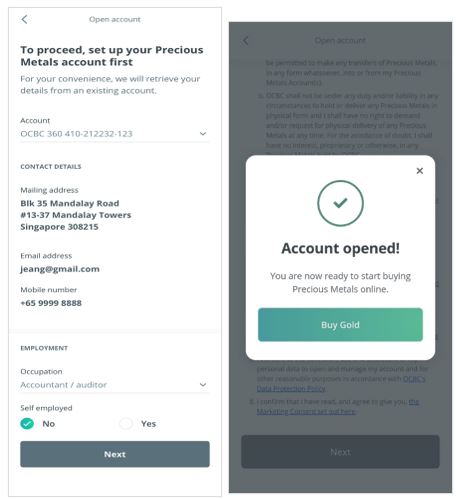

Customers can set up their precious metals account with just a few clicks on the OCBC Digital app. On the app dashboard, customers click the ‘Invest’ option on the main drop-down menu, then click ‘Gold, Silver’ to view the real-time pricing of both assets. After clicking ‘Buy Gold’ or ‘Buy Silver’, the app automatically populates customers’ data in the account set-up form on the next screen. Once customers click ‘Next’, the account is immediately live and active.

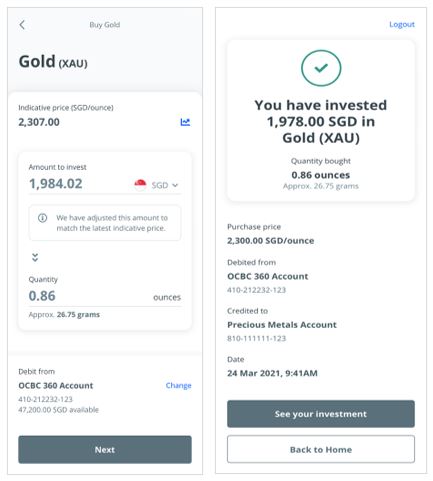

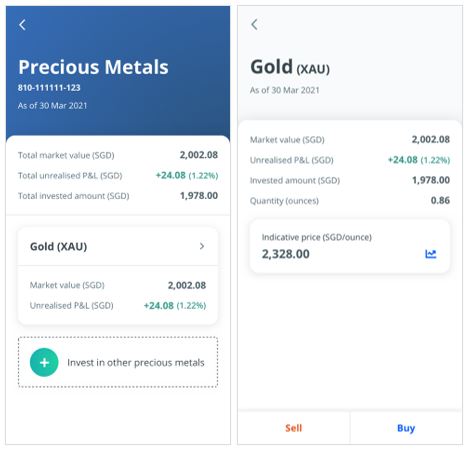

Once the account is active, customers can immediately purchase gold and silver by specifying the quantity they want to purchase, selecting the funding account and confirming the details. The purchase is completed in real-time and delivered to the customer’s precious metals account immediately.

Ms Eileen Goh, 32, a healthcare professional who has some investments but does not consider herself a savvy investor, said: “I have always wanted to own gold bars, but I was worried about the safety of keeping them at home. With this new feature on the OCBC Digital app, I was able to buy gold easily and quickly and did not even need to leave my room! I was a proud gold owner in less than five minutes.”

How to set up account and buy precious metals instantly

Step 1: See real-time prices of assets, select ‘Buy Gold’ or ‘Buy Silver’

Step 2: Click once for instant account opening

Step 3: Enter investment amount

Step 4: Track your investments