We would like to thank our generous sponsors for making this article possible.

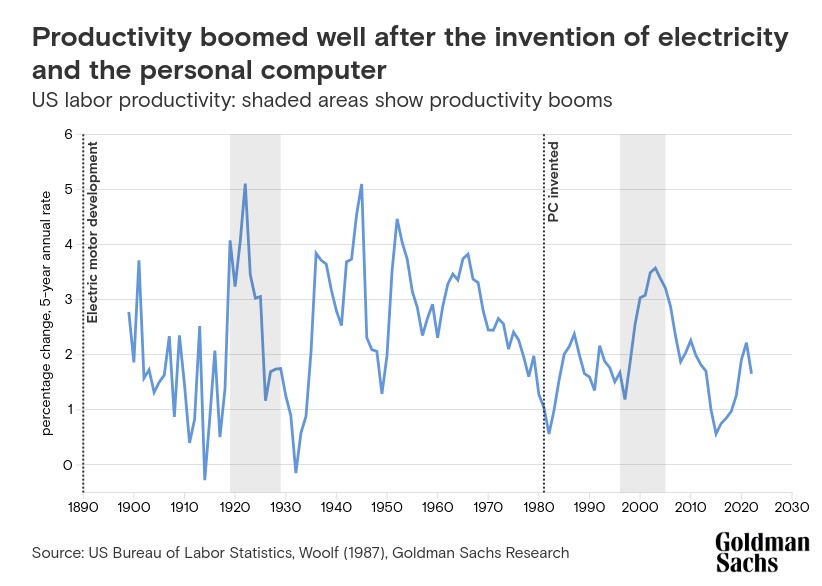

As investors look to understand how the boom in generative artificial intelligence may play out, lessons from the adoption of electricity and the internet may offer insight into how AI innovation will filter through financial markets, according to Goldman Sachs Research.

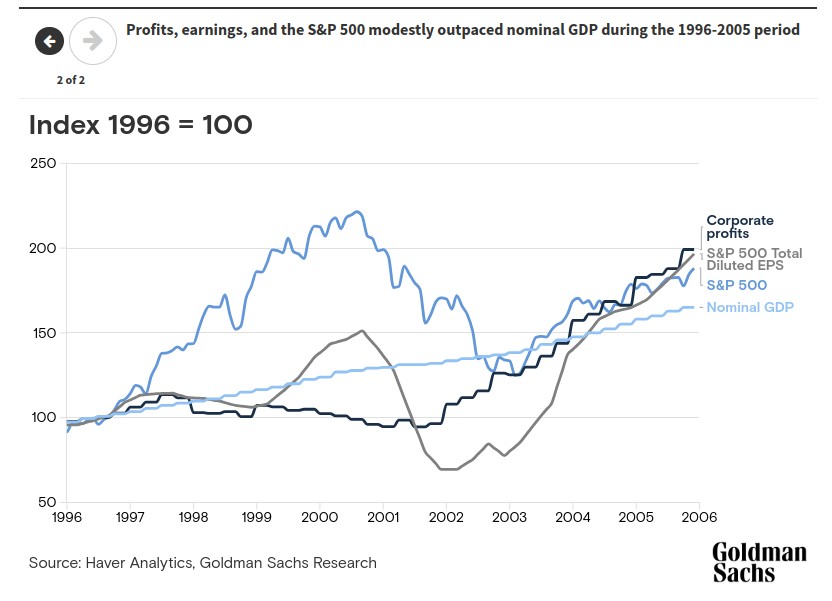

While there are limits to these comparisons — the transition to a peace-time economy following World War I and the emerging market crises in the late 1990s, for example, complicate the analysis — those periods of innovation-driven productivity booms from 1919-1929 and 1996-2005 are most comparable to the AI adoption underway now, Goldman Sachs Research Senior Advisor Dominic Wilson and analyst Vickie Chang write in the team’s report. The later episode allows for a fuller comparison due to data availability and change in financial markets. Over that full episode, U.S. equities had healthy if unspectacular gains, while company profits, earnings, and the S&P 500 outpaced nominal GDP by a modest amount.

Both the Federal Reserve’s policy rate and 10-year Treasury yields were clearly lower in 2005 relative to 1996 and tracked the pattern of the cycle in domestic demand. The U.S. dollar was little changed on net. Oil prices fell sharply during the emerging-market crises in 1997-98 but had risen by 2005.

But within that period, there was a large boom and bust in asset markets as Americans embraced the internet, according to Goldman Sachs Research. “During the initial boom, the pattern of market shifts, though not the magnitudes, match what you would broadly expect to see from an (over-)anticipated productivity boom,” Wilson and Chang write. “Equities rose sharply and valuations climbed to extreme levels.”

There was also an economic surge. The share of investment climbed, savings rates fell, and the current account deteriorated. Both the fed funds rate and longer-dated yields fell during the 1997-1998 period as the Asian financial crisis and Russia default hit, but with domestic demand booming, the funds rate rose to a fresh cycle peak in 2000. Longer-dated government bond yields rose, too, but remained below their 1996 levels amid low and stable inflation. The bust threw many of those movements into reverse. “Equities saw large declines, interest rates fell, and the bulk of the U.S. dollar strength reversed,” Wilson and Chang write.

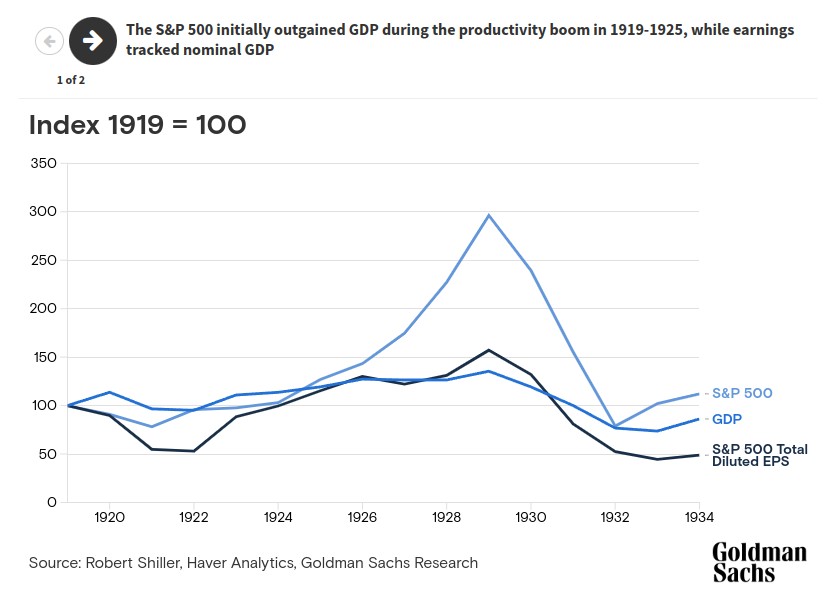

The evidence from the productivity boost in the 1920s as electricity adoption spread is sparser but has some parallel lessons. Equities again had sustained gains alongside the productivity boom. Once again, the equity market rally ended in outsized gains and a very sharp climb in equity valuations, followed by the crash of 1929. The story for Treasury bonds and foreign exchange is harder to map to today’s context given the differences in monetary policy and exchange rate management. Inflation was extremely low over the period. But the Fed’s discount rate again followed the economic and equity cycle, falling in 1924 as the economy weakened before rising steadily and hitting new peaks as the stock bubble accelerated and then burst, Wilson and Chang write.

These episodes suggest that movement in interest rates and currencies was more closely related to the domestic economic cycle than to structural changes in productivity, although the 1990s offer some support for the idea of foreign-exchange appreciation for economies that have outsized gains in productivity. The two prior experiences signal that the biggest impact on asset markets was in equities and equity valuations, and U.S. equities have already been the focus of the potential gains from AI so far.

But historical episodes also indicate there is a risk of a bubble where the market initially overpays for the productivity boom, impacting a broad set of assets. The experience of the 1990s suggests this dynamic could be associated not just with a period of unsustainably high equity prices, but also larger demand booms, greater foreign exchange appreciation, and higher interest rates in the leading AI-adoption countries than would have otherwise been the case.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Originally published at: Goldman Sachs