We would like to thank our generous sponsors for making this article possible.

Inflation is running red-hot—largely fueled by the ongoing supply chain crisis and the Russia-Ukraine conflict, which are in turn increasing food prices and energy prices. In the U.K., inflation recently hit double digits for the first time in 40 years, and is expected to climb to around 15% in 2023. Similarly in the U.S., inflation peaked at 9.1% in 2022, marking another 40-year high. This is squeezing household budgets, affecting consumer confidence and driving up the cost of living.

Will the cost of living increase further?

The price of many consumer staples is expected to increase even further in the coming months. J.P. Morgan Research expects the global Consumer Price Index (CPI)—which measures the change in prices consumers pay for goods and services—to rise again in the third quarter of 2022 (3Q 2022), reaching around 7.5% in the second half of 2022 (2H 2022). This is up from around 6.6% in the first half of 2022 (1H 2022), in part due to rising raw material costs.

“Even though spot prices have plateaued, input cost inflation will remain a key headwind until at least the first half of 2023 (1H 2023). As such, prices will rise further in 2H 2022 as corporates seek to offset some of these costs,” said Celine Pannuti, Head of Consumer Staples Equity Research at J.P. Morgan. Looking ahead, prices are expected to begin normalizing in 2023 as the effects of cost inflation ebb.

Even though spot prices have plateaued, input cost inflation will remain a key headwind until at least 1H 2023. As such, prices will rise further in 2H 2022 as corporates seek to offset some of these costs.

Celine Pannuti

Head of the European Food, Home and Personal Care Research, J.P. Morgan

How will inflation impact consumer confidence and spending?

Consumers are feeling the pinch, and many are rethinking their buying behaviors as a result—by cutting back on their overall expenditure, reducing spend on non-essential items and switching from premium products to lower-priced own-brand items.

1. Rising inflation means consumers will buy less overall

Many consumers are tightening their purse strings in response to the rising cost of living. According to data analytics firm Kantar, 47% of U.K. consumers have made or are expecting to make cutbacks in their general expenditure due to inflation. In the same vein, research by intelligence company Morning Consult shows that 56% of U.S. consumers are willing to shop less overall. Shoppers are prioritizing staples over discretionary goods and big-ticket items—some 75% said they will delay the purchase of an electronic device, while only 36% said they will buy fewer groceries. “When it comes to basic staples, demand has been quite resilient,” said Pannuti.

Even so, sales of household essentials are declining, with volume growth at major fast-moving consumer goods (FMCG) companies taking a hit. Data from market researcher NielsenIQ shows that sales volumes at U.K. supermarkets plunged in July this year by -9.4% for meat, fish and poultry, -8.1% for household items and -6.4% for packaged groceries.

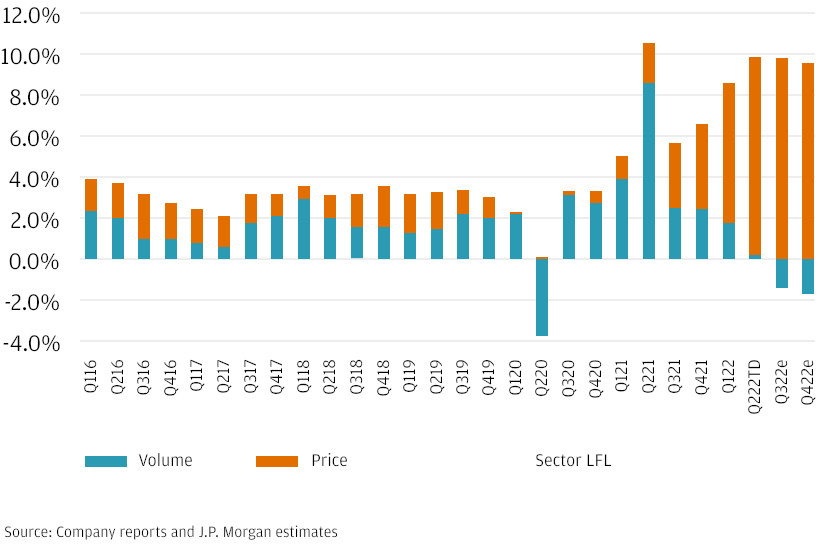

Despite this, companies have reported healthy 2Q earnings, largely bolstered by price hikes. “Corporates are starting to see slowing volumes, but when you factor in price rises of 10% or more, the overall impact on revenue is limited. The positive tailwinds of cost inflation are helping earnings,” said Pannuti. A case in point is Unilever. While the consumer goods conglomerate posted an underlying sales growth of 8.1% for the first half of 2022, this was driven by an increase of 9.8% in prices—volume sales actually decreased by 1.6%.

European food/home and personal care: price vs. volume

2. Due to higher inflation, consumers will trade down to own-label goods

Cash-strapped consumers are also trading down to own- or private-label goods—products sold under a retailer’s name, typically at a lower price than their branded counterparts—as a consequence of inflation. Around 40% of European consumers have tried a private-label brand this year, according to management consulting firm McKinsey & Company. This brand-switching behavior is particularly evident for staples such as household products (31%), snacks and confectionery (27%), frozen foods (29%) and dairy and eggs (26%).

Correspondingly, supermarkets across the globe are seeing increased consumer interest in private labels. Kantar notes that in the U.K., sales of own-label lines are climbing, especially for budget ranges such as Asda Smart Price and Co-op Honest Value, which both surged by a whopping 12%. On the other hand, sales of mainstream brands fell 1% over the same period. In the U.S., Walmart’s private brand penetration is increasing, with the growth rate in food categories doubling in 2Q 2022 versus 1Q 2022.

“Private labels broadly lost market share over 2020 and 2021, as big brands were beneficiaries of stronger supply chains and consumer demand for trusted brands. However, this has, to varying extents, gone into reverse during 2022 as the cost-of-living squeeze on consumers intensifies,” said Pannuti. “Now, private labels are staging a recovery after two years of market share losses.”

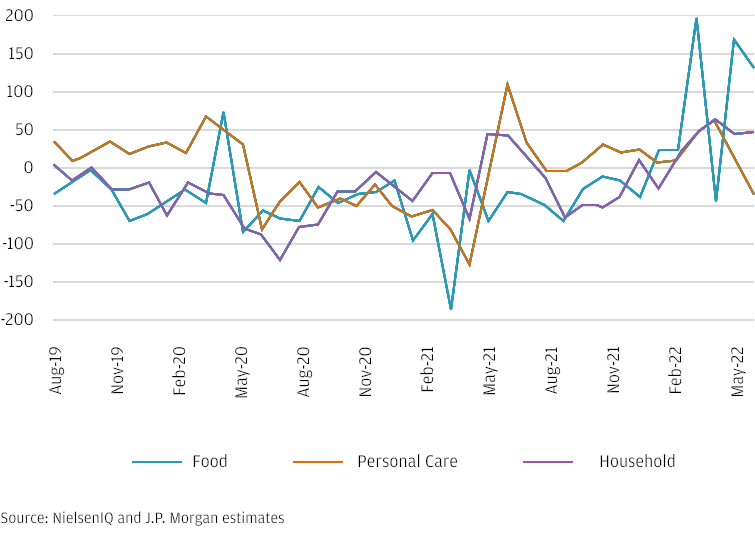

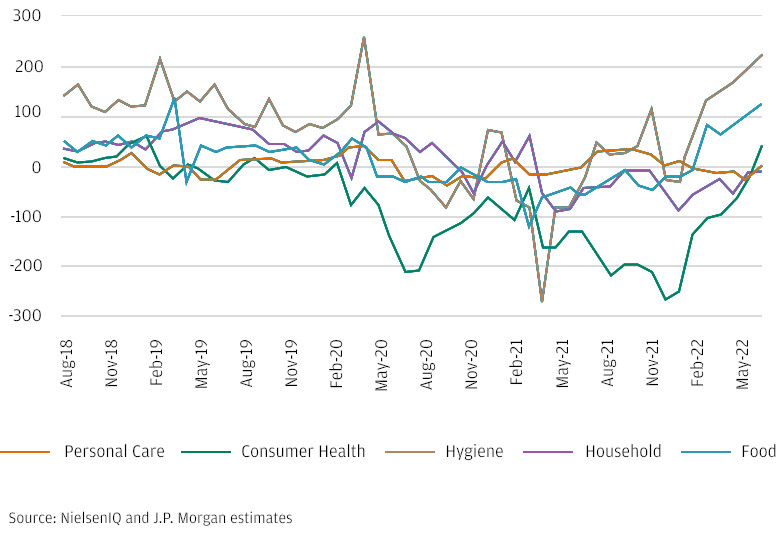

Private-label shares in Europe have started to exceed pre-pandemic levels, with sharp gains in the food sector—particularly for ice creams, yogurts and soups, J.P. Morgan estimates show. While they remain broadly below pre-COVID levels in the U.S., we see gains in 29 out of 47 key categories, including hygiene (paper towels and toilet tissue), bottled waters and baby food. Clearly, consumers are seeking more affordable alternatives to everyday essentials—a behavior that looks set to persist during these inflationary times.

Europe private-label shares in the food, personal care and household sectors

U.S. private-label shares in the personal care, consumer health, hygiene, household and food sectors

3. The effects of inflation on cost of living will be uneven across regions

J.P. Morgan Research expects Europe to be the epicenter of the cost-of-living squeeze as it is highly exposed to geopolitical tensions and accelerating inflation. “While Europe has held up quite well on the whole, the backdrop for the region gets even tougher in 2H 2022, when further pressures on consumer budgets are expected due to increased energy costs, and when the tailwinds from reopening start to fade,” said Pannuti. As such, consumers in this region may feel most compelled to trade down to cheaper alternatives.

In contrast, consumers in the Americas are likely to fare better. “To date, the U.S. has been the most resilient market through the pandemic and the period of rising inflation. Latin America has been the most dynamic region, with strong pricing and resilient volumes,” added Pannuti.

In Southeast Asia, the picture is fairly mixed, with some markets such as Vietnam seeing greater improvement in consumer confidence than other places such as Thailand, where government support packages are abating. “On the whole, growth in Southeast Asia has improved against two years of lower activity,” said Pannuti.

Consumer confidence is generally stronger in emerging markets, which are still rebounding from the COVID-induced slowdown. “For consumers in many of these markets, inflation is part of their day-to-day. They’re used to dealing with the effects of inflation,” said Pannuti.

Overall, despite these uneven impacts, inflation remains very much a pertinent issue across the globe. It will continue to impact the cost of living, shaping consumer confidence and spending habits in the months to come.

Originally published at: J.P. Morgan