We would like to thank our generous sponsors for making this article possible.

Will ESG become more of a deciding factor when making a purchase?

When choosing between types of personal care products, beverage options or household cleaners, factors like price and brand awareness – perhaps even package design – have served as key considerations. Now, as companies dial up their sustainability agendas and more shoppers seek out eco-friendly products, ESG criteria are poised to influence even more purchasing power. In a new report, J.P. Morgan Global Research explores how climate change is impacting the consumer staples sector.

Companies commit to more sustainable choices

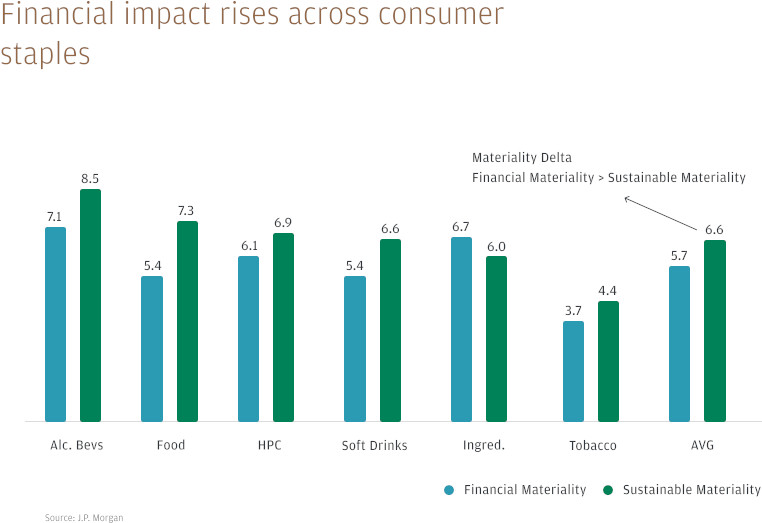

For the world’s largest personal care, food and drink companies, climate change mitigation has become one of the most important issues in decision-making. This has primarily been from a “sustainability materiality” perspective: the importance of ESG issues to all company stakeholders. On the flip side, “financial materiality,” or how important an ESG issue is to a company’s business model and valuation, has been slower to arrive.

According to J.P. Morgan Research, financial materiality is catching up. “The financial impact of climate change mitigation is emerging across the consumer staples sector and will become more evident as companies increase their investments in a circular economy and include carbon neutrality pledges in their ESG frameworks,” said Celine Pannuti, Head of European Consumer Staples and Beverages Research. “We see food producers as one of the sub-sectors most impacted by the issue, but also the most advanced in their pledges to mitigate climate change and in providing transparency around the potential costs to come.”

The three main food players – Danone, Nestle, Unilever – have each set roadmaps to implement Zero Net Carbon by 2050 at the latest, with visibility into incurred costs. Nestle has backed this ambition with an investment of CHF 3.2 billion ($3.6 billion) over the next five years. Danone has placed climate action at the center of their €2 billion ($2.4 billion) accelerated investment program, and Unilever’s brands will collectively invest €1 billion ($1.2 billion) in a new dedicated Climate & Nature Fund.

“We expect companies to increasingly communicate on the financial investments of ESG strategies with potentially higher costs limiting margin upside, and we believe this could morph into a key driver of product relevance as consumers are increasingly influenced by environmental matters,” added Pannuti.

Climate Change Mitigation

Reducing greenhouse gas emissions

to combat climate change.

We expect companies to increasingly communicate on the financial investments of ESG strategies with potentially higher costs limiting margin upside, and we believe this could morph into a key driver of product relevance as consumers are increasingly influenced by environmental matters.

Celine Pannuti

Head of the European Food, Home and Personal Care Research, J.P. Morgan

Financial impact rises across consumer staples

While the biggest gap between sustainability and financial materiality exists in Food & Beverages, financial materiality is becoming realized as companies disclose on investments.

A growing shift in consumption preferences

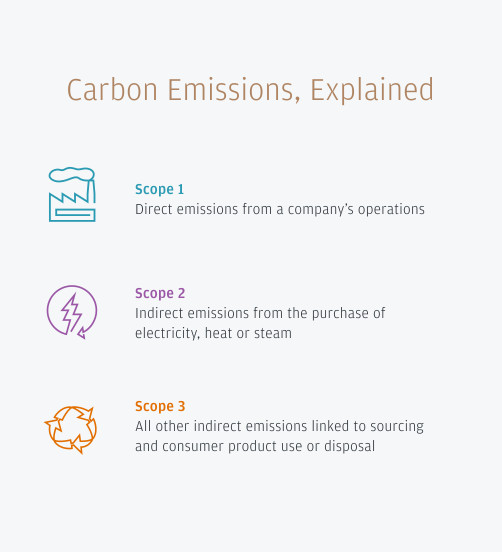

While it’s challenging to directly compare the Greenhouse Gas footprint between companies, Scope 3 emissions appear to be the most dominant type according to J.P. Morgan Research.

“Across consumer staples, Scope 3 emissions are approximately 95% of a company’s total GHG emissions,” said Pannuti. “These are top of mind for consumers who consider products and brands for being sustainably sourced or having a positive environmental impact, and for ESG investors looking at a company’s relative performance on climate change.”

While carbon reduction targets are now fairly common on a company’s ESG agenda, the scope, ambition and financial backing can vary. When assessing progress on emissions across consumer staples, J.P. Morgan Research notes good progress on Scope 1 & 2 emissions, but generally slower progress on Scope 3.

Despite the slower pace, eforts to address Scope 3 emissions are becoming increasingly embedded in corporate investments, such as regenerative agriculture. There are also key areas of intersection with other ESG focus areas. “Eliminating deforestation and establishing reforestation policies are significant components of Scope 3 ambitions for many companies across the sector,” Pannuti noted. “We’re seeing more investment in the circular economy, such as recycling technology, given the sizeable carbon footprint impact.”

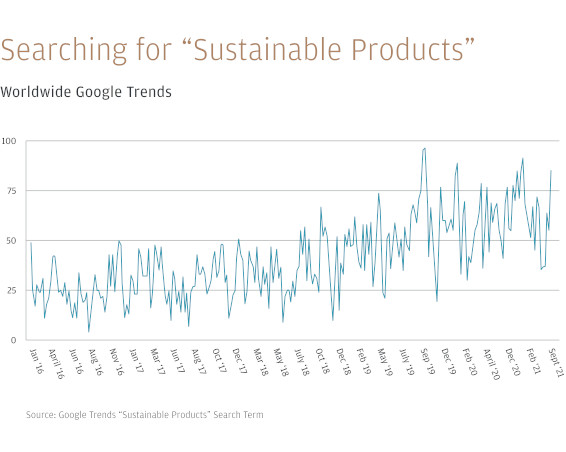

Google Trend data also indicates these issues as top-of-mind for consumers. While the term “climate change” has trended over the long-term, but there has been a recent rise in searches for “sustainable products,” “eco-friendly” and “environmentally friendly,” suggesting a shift in consumption preferences and are more likely to be attached to a product choice. ESG considerations will increasingly drive consumer purchasing decisions, as consumer attention focuses sharply on transparent reporting of ESG issues, ranging from the climate crisis to issues of diversity & inclusion.

Our view is that this rising collective consciousness of sustainability among consumers is influencing more forceful strategic choices by companies, and increasingly determining opportunities, risks and innovation across product categories and brands.

Jean-Xavier Hecker & Hugo Dubourg

Co-Heads of ESG & Sustainability Research, J.P. Morgan

“Our view is that this rising collective consciousness of sustainability among consumers is influencing more forceful strategic choices by companies, and increasingly determining opportunities, risks and innovation across product categories and brands,” said Jean-Xavier Hecker & Hugo Dubourg Co-Heads of Sustainability & ESG Research.

“This, in turn, could materially impact a company’s financials and valuation. In many cases, companies are currently reporting only anecdotal or sporadic evidence of these trends. But many corporates now expect sustainability issues to become increasingly important over time when it comes to consumption drivers and financial impact. Particularly, with products at the heart of the consumer staples business, product liability is the most financially material ESG issue for the sector. This includes environmental impact, health impact, responsible marketing & labeling, product quality & safety, illicit trade and responsible innovation.

This trend has the potential to drive meaningful brand diferentiation and marketing opportunities. “We expect to see more forthright marketing on sustainability attributes going forward, including carbon labeling, which anticipate being efective in communicating sustainability credentials to consumers, as long as it is validated and goes hand-in-hand with broader education so the data can be as easily interpreted as nutritional values on packaging,” said Pannuti. In recent years, plant-based brands Quorn and Oatly have adopted carbon labeling. L’Oréal has pledged to introduce Environmental and Social Impact Labeling, with an A to E score, across all rinse-of products by 2022. The efort is currently in place on Garnier’s haircare product webpages in France. For the investor community, a carbonadjusted Earnings Per Share (EPS) may be an efective means of communicating progress, notes Pannuti. Danone announced this strategy in early 2020, using a price of €35 or $42/ton of carbon.

ESG materiality across staples: responsible sourcing and product liability dominate

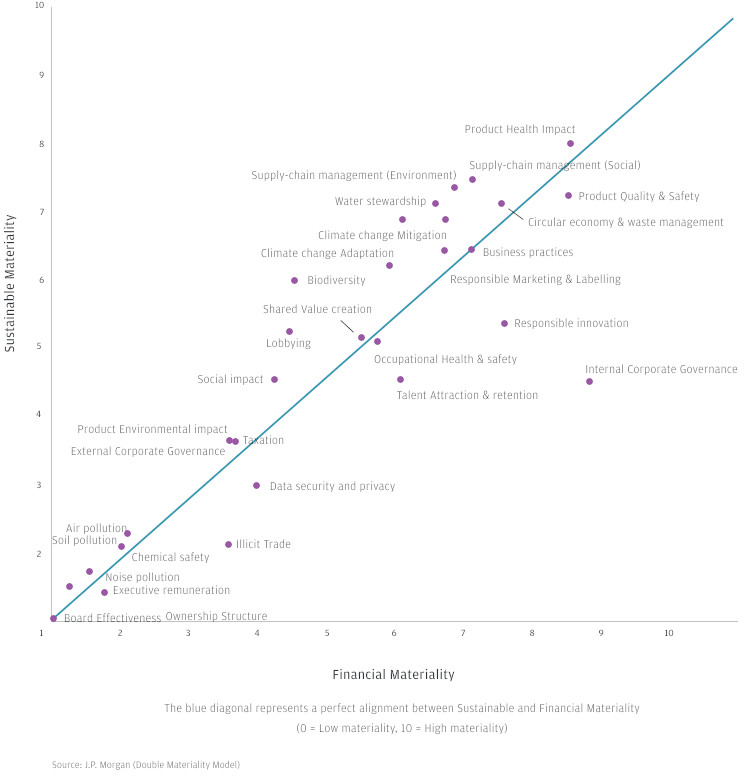

When looking across the consumer staples sector, J.P. Morgan Research assessed both sustainability and financial materiality. The materiality delta, or the diference between Sustainable Materiality and Financial Materiality, is the highest for Biodiversity and Diversity.

“We believe that these large materiality deltas should attract significant attention. In the long-run, we expect Sustainability and Financial Materiality to more closely correlate as market participants integrate Sustainability considerations into their investment decisions,” says Hecker & Dubourg. “It is our view that companies should increase and improve materiality disclosure to help stakeholders’ understanding of the positioning of ESG issues in value chains.”

Breaking down the matrix:

- Responsible Sourcing: More important from a Sustainability perspective and “average” from a financial perspective. This likely reflects the fact that companies usually don’t incur significant financial penalties when violations occur in their supply chains.

- Product Quality & Safety: More important from a financial perspective. Issues in this area can result in costly recalls, impacting customer satisfaction and brand perception. Also, responsible innovation and product health are important factors to manage as consumer preferences change regularly.

- Water Stewardship and Climate Change: More important from a sustainability perspective. This is due to low climate-related transition risk for the sector (e.g. no carbon tax applied on food products, limited impact of emission trading programs on operations, etc.), while physical risks, including water scarcity, are worsening. Financial and sustainable materiality for both categories are expected to increase and more closely align.

- Circular Economy & Waste Management: Financial and sustainable materiality are well-aligned. Concerns around plastics and packaging are driving consumer decisions and will likely result in higher costs.

- Health & Safety and Human Capital Management (employee-related operational issues): Well-aligned from a financial and sustainable materiality perspective.

- Corporate Governance: While important for the business and stakeholders, a relative lack of integration within materiality matrices exists.

Originally published at: J.P. Morgan