We would like to thank our generous sponsors for making this article possible.

The luxury market should see two vastly different dynamics playing out in the coming months. How will this impact luxury shoppers and brands?

- Consumers in the U.S. are reducing their spending on non-essential goods, and this is weighing on luxury sales.

- However, China’s reopening is a tailwind for the sector, especially as Chinese consumers are a major driver of luxury spending.

- Upscale brands — along with hard luxury goods such as watches and jewelry — are expected to be most resilient amid this uncertain macro environment, depending on specific brand momentum.

During the current cost-of-living crisis, consumers are cutting back on spending — but demand for luxury goods remains high. In the fourth quarter of 2022, the luxury market grew 7% organically year-over-year, figures from J.P. Morgan Research show.

“Investors are seemingly turning more constructive on the luxury sector,” observed Chiara Battistini, Head of European Luxury and Sporting Goods at J.P. Morgan. “But while the sector is more resilient, we also note that it has never been immune to macro dynamics and has historically been late cyclical.”

Looking ahead, will ongoing macro uncertainty take a toll on the luxury industry? And will China’s reopening boost the sector’s fortunes?

While the luxury sector is more resilient, we also note that it has never been immune to macro dynamics and has historically been late cyclical.

Chiara Battistini

Head of European Luxury and Sporting Goods, J.P. Morgan

U.S. and Europe: Luxury shoppers are tightening their purse strings

“The strength and resilience of the Western consumer in 2022 has been impressive. However, fourth-quarter sales numbers have shown signs of ongoing normalization,” said Battistini.

In the third edition of J.P. Morgan’s Cost of Living survey, which polled 5,000 consumers across the U.S. and Europe in March 2023, nearly 75% of U.S. consumers said they expect to reduce spending on non-essential goods by at least 6%. European consumers feel less worried about their financial circumstances compared with six months ago, but again, almost 75% expect to decrease discretionary spending by over 6%.

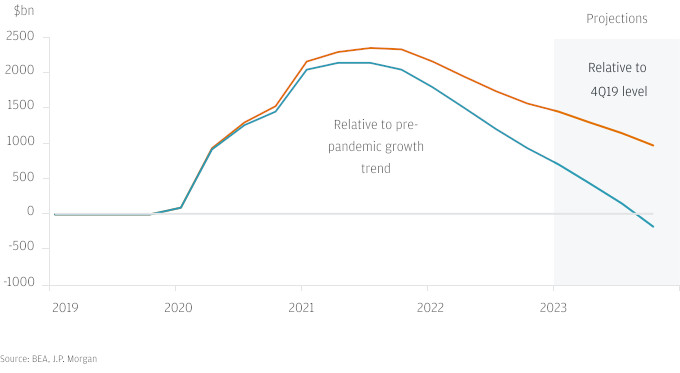

This is partly because consumers are using up the excess savings they accrued during the pandemic. According to J.P. Morgan Research, excess savings in the U.S. peaked at around $2.1 trillion in the second quarter of 2021, decreasing to an estimated $800 billion in the fourth quarter of 2022. This savings cushion is forecast to be fully depleted by the third quarter of 2023.

U.S. consumers are depleting their excess savings

Waning consumer confidence is in turn weighing on sales across most luxury brands covered by J.P. Morgan Research. “Corporates in the U.S. have flagged this is mainly due to American tourists buying more in Europe, but we note that sales growth across both markets is still slowing,” said Battistini. Indeed, the regions’ combined organic sales growth fell to 11% year-over-year in the fourth quarter of 2022, down from 17% in the third quarter.

“Assuming further trend moderations in these two key regions, we would reduce the upside risk to estimates of our regional analysis to 3% on sales and 6–7% on profits,” said Battistini.

China: Shoppers are back and spending on luxury goods

On the other hand, China’s recent reopening is expected to be a tailwind for the sector, especially as Chinese consumers are a major driver of luxury spending. During the 2021 financial year, luxury goods companies generated around 30% of their total sales in Greater China. However, business took a hit during COVID-19, with most brands posting around a 10% decline in sales for the 2022 financial year.

Like consumers elsewhere, Chinese shoppers have accumulated excess savings over the past three years. J.P. Morgan Research estimates that the average saving rate in China was 33.5% in 2022, up from 29.9% in 2019. This, along with pent-up demand, is fueling post-pandemic revenge spending.

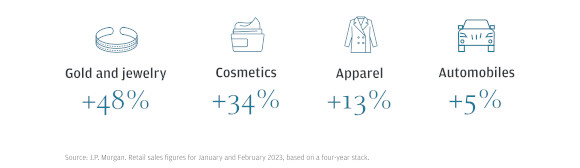

Indeed, domestic luxury sales are booming. In January and February 2023, total retail sales in China were up 17% on a four-year stack. There was sequential improvement across all segments tracked by J.P. Morgan Research, including gold and jewelry (+48%), cosmetics (+34%) and apparel (+13%). Demand for luxury timepieces is rising, too: Swiss watch exports to China accelerated to +68% on a four-year stack in February 2023.

What are Chinese shoppers buying?

In addition, Chinese consumers are traveling again, which could boost overseas spend on luxury goods. In March 2023, outbound flights to Italy and Korea reached 65.4% and 34.9% of 2019 average levels respectively. However, it remains to be seen if this will drive the luxury sector’s growth, especially as goods in this category have recently become more affordable in China thanks to reduced import duties.

“In our view, the piece of the puzzle that is most difficult to square is how much the return of travel will contribute incrementally to growth, versus cannibalizing the existing sales already taking place domestically,” said Battistini. “We think this should provide more sizeable support to 2024 rather than 2023, given visa requirements and the fact that flight numbers are still relatively subdued.”

Overall, the return of the Chinese consumer looks set to be a huge boon for the luxury industry. “We think that if pent-up demand comes through fully in 2023, luxury companies could post around 35–40% sales growth in China this year,” said Battistini.

Luxury brands: A return on investment?

“While China’s reopening should benefit the whole sector, we expect the magnitude to vary depending on specific brand momentum, with consumers gravitating first and most to brands and products they want to buy and wear,” noted Battistini.

Against a deteriorating macro backdrop, upscale brands stand to emerge as winners. “If the consumer becomes sensitive to inflation, we would expect higher-ticket items and coveted brands in leather goods to be more protected. Consumers might also favor purchasing hard luxury items such as watches and jewelry, which potentially represent a more attractive investment,” said Battistini. This is reflected in rising Swiss watch exports, which were up 12% year-over-year in February 2023 in value terms, according to J.P. Morgan Research.

That said, luxury brands across the board will likely ramp up their marketing efforts to boost sales amid challenging market conditions. “We saw an increase in operating expenses in the second half of 2022, mostly due to higher marketing spend to maintain and further drive brand momentum,” noted Battistini. “This raises a question mark about the investments needed to excite and engage consumers, who are becoming ever more demanding.”

This communication is provided for information purposes only. Please read J.P. Morgan research reports related to its contents for more information, including important disclosures. JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively, J.P. Morgan) normally make a market and trade as principal in securities, other financial products and other asset classes that may be discussed in this communication.

This communication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy except with respect to any disclosures relative to J.P. Morgan and/or its affiliates and an analyst’s involvement with any company (or security, other financial product or other asset class) that may be the subject of this communication. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. J.P. Morgan Research does not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein. Periodic updates may be provided on companies, issuers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, J.P. Morgan may be restricted from updating information contained in this communication for regulatory or other reasons. Clients should contact analysts and execute transactions through a J.P. Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of J.P. Morgan. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitutes your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of J.P. Morgan.

Originally published at: J.P. Morgan